PostSig Launches Investor Rights Intelligence as Venture Firms Prepare for Aumni Sunset

FOR IMMEDIATE RELEASE

January 7, 2026

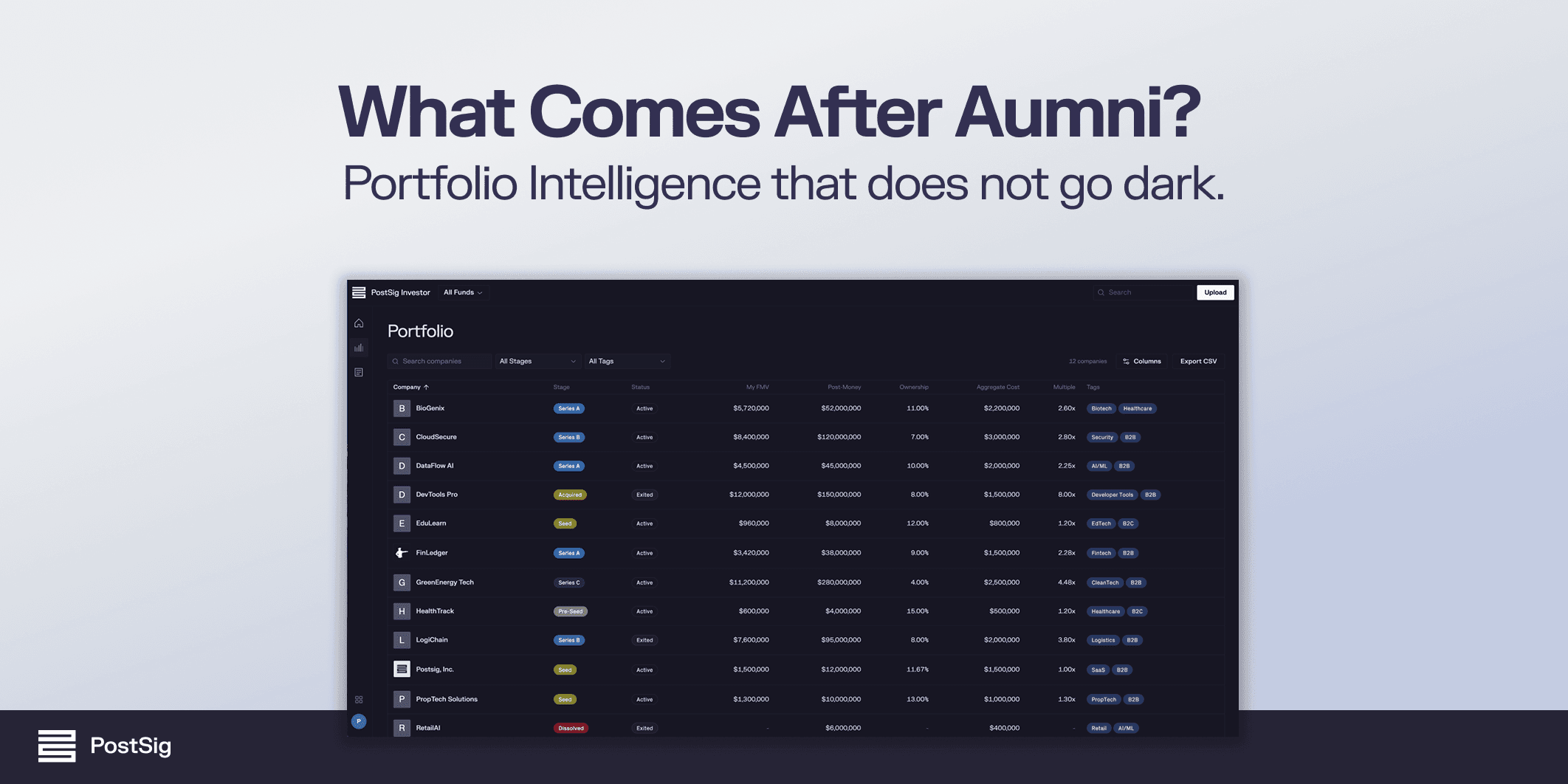

San Francisco, CA — January 7, 2026 — PostSig today announced the launch of its Investor Rights Intelligence solution, a new product designed to help venture capital firms maintain governance clarity and investor rights continuity following J.P. Morgan’s decision to sunset the Aumni platform.

J.P. Morgan has announced that Aumni will stop processing new documents on January 15, 2026, with full platform access ending on March 31, 2026. As a result, many venture firms and limited partners are reassessing how they manage portfolio documentation, governance rights, and institutional knowledge during and after the transition.

Investor Rights Intelligence provides both a transition path and a step forward by moving portfolio oversight beyond static records toward continuously updated execution.

Aumni helped firms centralize historical investment data. As portfolios grow more complex, however, firms face a different challenge: ensuring that investor rights, approvals, and governance obligations remain accurate and enforceable as investments evolve through financings, amendments, restructurings, and board actions. PostSig built Investor Rights Intelligence for that reality.

Rather than acting as another system of record, PostSig surfaces the intelligence needed to understand key governance and economic terms in a single, continuously current view. By connecting documented investor intent with the decisions and actions taken across a portfolio, PostSig eliminates manual document review, saves time, and enables more strategic portfolio management as investments evolve.

Investment agreements encode consent thresholds, information rights, governance controls, and protections. Over time, that intent becomes fragmented across amendments, side letters, subsequent rounds, and operational decisions. Investor Rights Intelligence is designed to prevent that fragmentation by maintaining continuous lineage across investment documents and keeping investor rights visible, current, and defensible as portfolios change.

“Systems of record tell you what was signed,” said Hendrik Bartel, CEO and Co-Founder of PostSig. “Investor Rights Intelligence ensures that what was signed still governs execution as portfolios evolve. That’s the shift this moment requires.”

With Aumni’s discontinuation, venture firms need more than a document repository. They need continuity without recreating fragile, manual workflows. Investor Rights Intelligence enables firms to transition portfolio documents into a living intelligence layer, preserve institutional knowledge without constant re-interpretation, and operate with confidence as documents, rights, and portfolio conditions change.

Nick Adams, Managing Partner at Differential Ventures and lead investor in PostSig, commented, “When Aumni announced its sunset, it created urgency, but it also created clarity. The next generation of portfolio oversight is not about better snapshots of the past. It is about execution that keeps rights and control aligned as things change. Investor Rights Intelligence reflects exactly where this market is going.”

Investor Rights Intelligence is available today. Venture firms are already onboarding the solution as they establish a durable, continuously updated foundation for portfolio governance going forward.

To learn more or request a walkthrough, visit postsig.com.